What Is The Depreciable Life Of Furniture . Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Importance of fixed asset useful life in financial planning and reporting. Based on the calculations, depreciation is $5,000 per year for 10 years. You can write off the $5,000 per year for 10 years. Overview of different categories of.

from saylordotorg.github.io

You can write off the $5,000 per year for 10 years. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. Overview of different categories of. Importance of fixed asset useful life in financial planning and reporting.

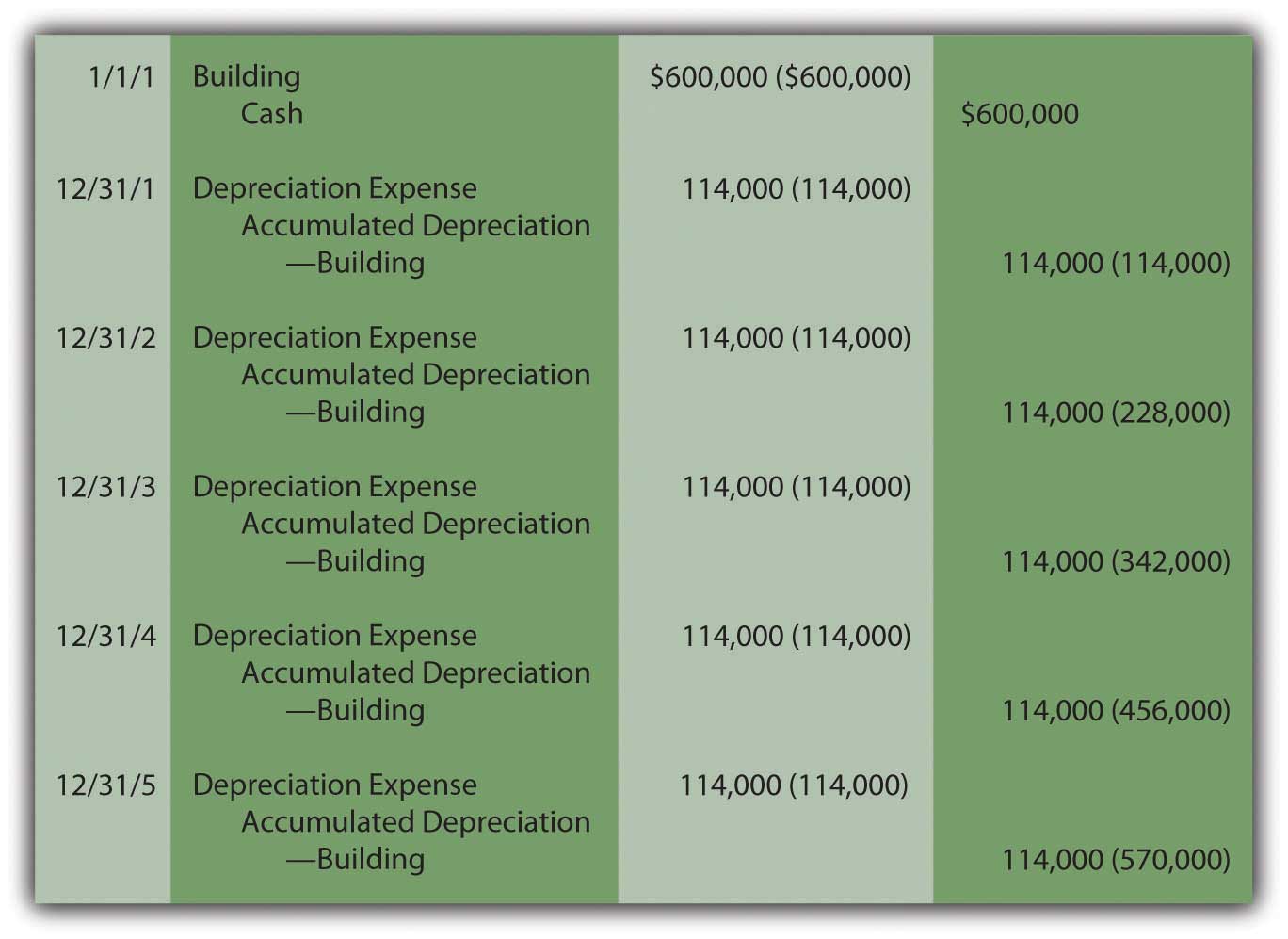

Determining Historical Cost and Depreciation Expense

What Is The Depreciable Life Of Furniture Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Overview of different categories of. You can write off the $5,000 per year for 10 years. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and reporting. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy.

From maryrbequettexo.blob.core.windows.net

What Is The Depreciation Rate On Furniture What Is The Depreciable Life Of Furniture You can write off the $5,000 per year for 10 years. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Importance of fixed asset useful life in financial planning and reporting. Based on the calculations, depreciation is $5,000 per year for 10. What Is The Depreciable Life Of Furniture.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table What Is The Depreciable Life Of Furniture You can write off the $5,000 per year for 10 years. Overview of different categories of. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Importance of fixed asset useful life in financial planning and reporting. Based on the calculations, depreciation is. What Is The Depreciable Life Of Furniture.

From www.irs.gov

Publication 946 (2017), How To Depreciate Property Internal Revenue What Is The Depreciable Life Of Furniture Overview of different categories of. You can write off the $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and reporting. Based on the calculations, depreciation is $5,000 per year for 10 years. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and. What Is The Depreciable Life Of Furniture.

From www.superfastcpa.com

What is Depreciable Cost? What Is The Depreciable Life Of Furniture Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. You can write off the $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and. What Is The Depreciable Life Of Furniture.

From www.educba.com

Depreciation Expenses Formula Examples with Excel Template What Is The Depreciable Life Of Furniture You can write off the $5,000 per year for 10 years. Overview of different categories of. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful. What Is The Depreciable Life Of Furniture.

From www.slideserve.com

PPT DEPRECIATION ACCOUNTING PowerPoint Presentation, free download What Is The Depreciable Life Of Furniture Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Overview of different categories of. Importance of fixed asset useful life in financial planning and reporting. You can write off the $5,000 per year for 10 years. Based on the calculations, depreciation is. What Is The Depreciable Life Of Furniture.

From slidecourse.blogspot.com

Useful Life Of Furniture For Depreciation Slide Course What Is The Depreciable Life Of Furniture Importance of fixed asset useful life in financial planning and reporting. Based on the calculations, depreciation is $5,000 per year for 10 years. Overview of different categories of. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. You can write off the. What Is The Depreciable Life Of Furniture.

From www.chegg.com

Solved On March 31, 2024, Susquehanna Insurance purchased an What Is The Depreciable Life Of Furniture Based on the calculations, depreciation is $5,000 per year for 10 years. You can write off the $5,000 per year for 10 years. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Overview of different categories of. Importance of fixed asset useful. What Is The Depreciable Life Of Furniture.

From docs.oracle.com

Depreciation Calculation for Table and Calculated Methods (Oracle What Is The Depreciable Life Of Furniture Importance of fixed asset useful life in financial planning and reporting. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. Overview of different categories of. You can write off the. What Is The Depreciable Life Of Furniture.

From www.issuewire.com

Estimated Useful Lives of Depreciable Lodging Assets IssueWire What Is The Depreciable Life Of Furniture Importance of fixed asset useful life in financial planning and reporting. Overview of different categories of. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. You can write off the $5,000 per year for 10 years. Based on the calculations, depreciation is. What Is The Depreciable Life Of Furniture.

From flyfin.tax

Depreciation As A Tax Deduction For Selfemployed Individuals What Is The Depreciable Life Of Furniture You can write off the $5,000 per year for 10 years. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and. What Is The Depreciable Life Of Furniture.

From www.chegg.com

Solved On March 31, 2024, Susquehanna Insurance purchased an What Is The Depreciable Life Of Furniture Importance of fixed asset useful life in financial planning and reporting. You can write off the $5,000 per year for 10 years. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10. What Is The Depreciable Life Of Furniture.

From www.homeworklib.com

stering Depreciation uses the straightline method. Assets purchased What Is The Depreciable Life Of Furniture Overview of different categories of. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and reporting. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. You can write off the. What Is The Depreciable Life Of Furniture.

From www.bmtqs.com.au

Depreciation For Boutique Hotels BMT Insider What Is The Depreciable Life Of Furniture You can write off the $5,000 per year for 10 years. Overview of different categories of. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful. What Is The Depreciable Life Of Furniture.

From kitchenequipmenthankasa.blogspot.com

Kitchen Equipment Kitchen Equipment Depreciation Life What Is The Depreciable Life Of Furniture Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. You can write off the $5,000 per year for 10 years. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and. What Is The Depreciable Life Of Furniture.

From www.chegg.com

TABLE 113 MACRS Depreciation for Personal Property What Is The Depreciable Life Of Furniture You can write off the $5,000 per year for 10 years. Based on the calculations, depreciation is $5,000 per year for 10 years. Importance of fixed asset useful life in financial planning and reporting. Overview of different categories of. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and. What Is The Depreciable Life Of Furniture.

From specialties.bayt.com

What is your definition for the financial term "Depreciation"? What Is The Depreciable Life Of Furniture Importance of fixed asset useful life in financial planning and reporting. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. Overview of different categories of. You can write off the. What Is The Depreciable Life Of Furniture.

From www.numerade.com

SOLVED Estimating Useful Life and Percent Used Up The property and What Is The Depreciable Life Of Furniture Importance of fixed asset useful life in financial planning and reporting. Depreciation rates can vary depending on a number of factors, including the material used to make the furniture, its age, and the current state of the economy. Based on the calculations, depreciation is $5,000 per year for 10 years. You can write off the $5,000 per year for 10. What Is The Depreciable Life Of Furniture.